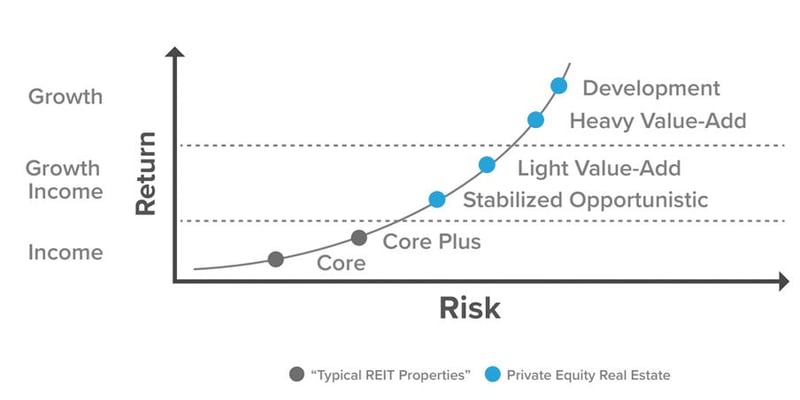

Commercial real estate investors have looked to core and core plus strategies for decades as dependable alternative sources of income. While these two stalwart approaches to real estate ownership remain attractive, investors focused on growth and capital appreciation should look at alternate strategies, including real estate development projects.

Today, the landscape for growth investing is full of challenges. Persistent inflation, the potential for a looming recession, geopolitical uncertainty, and increased market volatility have financial professionals looking to asset classes like private real estate to help provide the types of returns their clients are accustomed to. Development and redevelopment (converting one property type to another) real estate strategies may be a viable approach to meeting those needs because an experienced developer can create value relatively quickly.

RETURN OBJECTIVES DETERMINE APPROPRIATE STRATEGY

Commercial Real Estate Investment Risk Return Profiles1

Development Real Estate

Development real estate can offer higher return potential but also carries higher levels of risk due to its speculative nature. The potential for attractive returns today, as interest rates remain high, is bringing increased awareness to development projects. As noted in the CBRE 2023 Investor Intentions Survey2, more investors intend to implement development strategies than last year.

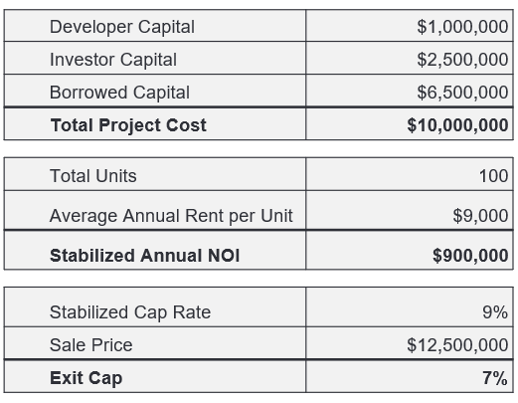

Create Growth Through Cap Rate Compression

Ideally, investors want to buy at a high cap rate and sell at a lower one. Cap rate, or capitalization rate, is a standard commercial real estate metric used to approximate value through a formula of dividing net operating income by the initial purchase price. When cap rates decline, which is typically seen late in the real estate cycle, valuations can increase and investors can realize significant appreciation.

As the cap rates begin to shift, the industry typically experiences a period where buyers and sellers are sitting on the sidelines waiting for the other to make a move (in price). This is exacerbated when interest rates rise quickly, as they have over the past 12 months, causing buyers to want or need to pay less for real estate while sellers are unwilling to reduce their selling price.

How does one create value in this environment? As this hypothetical example shows, a development project enables an operator to create their own cap rate compression and subsequently, investor growth.

CREATING GROWTH POTENTIAL THROUGH CAP RATE COMPRESSION

Hypothetical Example

Opportunities with Distressed Assets

Don’t let the term “distressed” create the wrong picture. In the case of redevelopment, often the physical structure is sound, but the owner could be in financial distress and being forced to sell at a discount. This provides an interesting opportunity for an experienced real estate firm with a strong balance sheet to purchase and repurpose an existing structure into a desirable type of real estate for an attractive price.

A Few Other Considerations

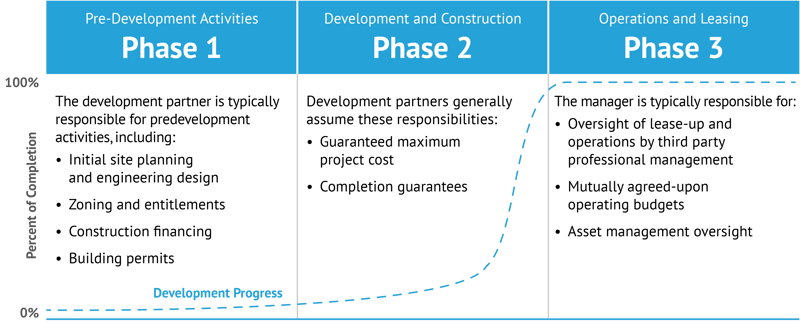

Development projects are not for faint-of-heart investors. They take years to build and require the developer to have exceptional skills in every phase of the development.

PHASES OF DEVELOPMENT

The phase at which you enter the development process has a significant impact on your ability to mitigate risk. For example, if you enter into a development project in the pre-development activities of Phase I, there is often uncertainty about your investment time horizon and, therefore, your return potential.

On the other hand, if you enter a project in Phase II, when the project is shovel-ready, you may have a shorter investment time horizon, and the number of variables that could impact the project’s timing may be largely reduced.

In 2023, introducing your clients to a strategy involving opportunistic commercial real estate development or redevelopment strategy may provide an exciting option beyond stocks and bonds. With high interest rates, stubborn inflation, geopolitical uncertainty, and a skittish market making your job challenging, your education and guidance on these types of investments can be invaluable to your clients.

1. This chart is a generic representation of a return vs. risk comparison. There can be no assurance that return objectives for a development project will be achieved. Actual returns in any development project will depend on the ability of the developer to develop the property in accordance with the approved development budget and within the approved development schedule, which are subject to conditions beyond the control of the subject fund.