Swift and Soaring

With the May 2022 consumer price index weighing in at 8.6% year over year, few believe that our 40-year high inflation is going away any time soon. And the fact the rise in consumer prices happened so quickly has many economists concerned that inflation could go significantly higher.

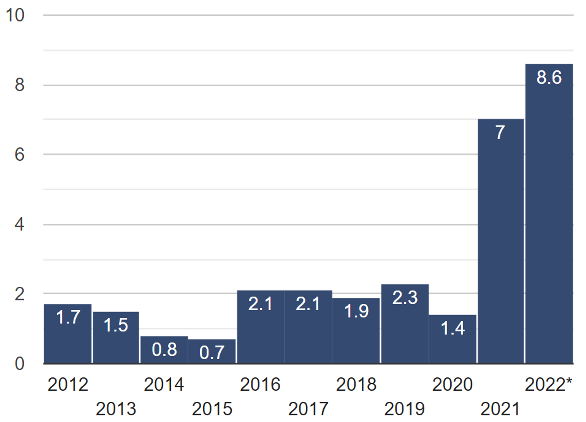

United States Annual Inflation Rate (2012-2022)

Source: usinflationcalculator.com. *The latest inflation data (12-month based) is always displayed in the chart’s final column. Data as of May 2022.

Movement to Hedge

Most RIAs we talk to have made moves to help insulate client portfolios from the effects of inflation. While many held their breath, hoping that Fed Chairman Jerome Powell’s 2021 prediction that high prices would prove transitory, our persistent inflationary environment has moved many advisors to adopt inflation hedging strategies.

Among the common strategies used by advisors during rising price environments – TIPS, gold, commodities – commercial real estate (CRE) strategies appear to be drawing widespread interest for various reasons. For those focused on income and preserving purchasing power, CRE may provide advantages over other inflation-hedging asset classes.

Potential to Outpace

While inflation may have a sizable impact on many asset classes, investors in tangible assets such as CRE may benefit from rising inflation rates, including the potential for returns that outpace inflation.

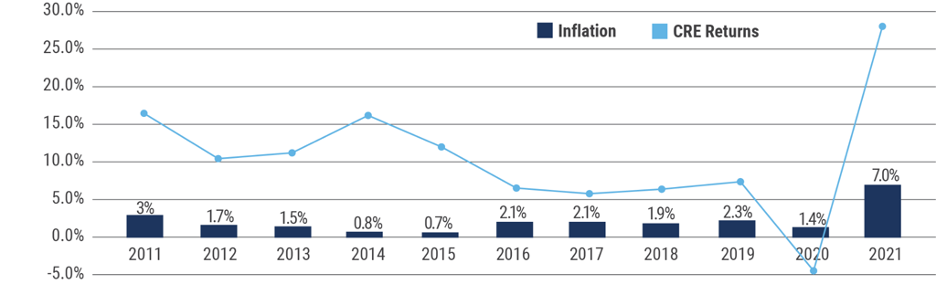

Historical Real Estate Performance vs. Inflation (2012-2022)

Note: Past performance is not a guarantee of future results.

Note: Past performance is not a guarantee of future results.

Inflation Source: US Inflation Calculator, Historical Inflation Rates 1914-2021

CRE Returns Source: Green Street Advisors, Commercial Property Return Index (CPRI).

Green Street Advisor’s CPRI is a time series of unleveraged U.S. commercial property values that captures the prices at which commercial real estate transactions are contracted and includes the income component from investing in property. The index measures price changes across fifteen property types.

CRE Can Help Sidestep Inflation’s Influence on the Markets

Inflation can negatively affect the performance of stocks and bonds. Inflation stokes many fears, which contributes to heightened market volatility. And with rising interest rates, corporate borrowing costs increase, pulling down earnings and stock valuations.

Since CRE has a low correlation to publicly traded securities, the asset class generally offers strong fundamentals amid challenging economic environments that can impact stock and bond performance. Moreover, many CRE sectors usually experience consistent demand as people have essential needs for places to live, work, eat, and shop.

Real Estate Values Tend to Rise with Inflation

CRE holds intrinsic value because the demand for real estate properties does not typically decrease, even when inflation rates rise. Rising inflation generally indicates a potential increase in property values and the cost of real estate development.

Since building materials and labor prices will be higher in an inflationary environment, developers will need to spend more to build new structures, increasing the price of new real estate properties. Moreover, current property values may also rise due to a limited supply given the rising cost of construction.

Rents Can Rise with (or Exceed) Inflation

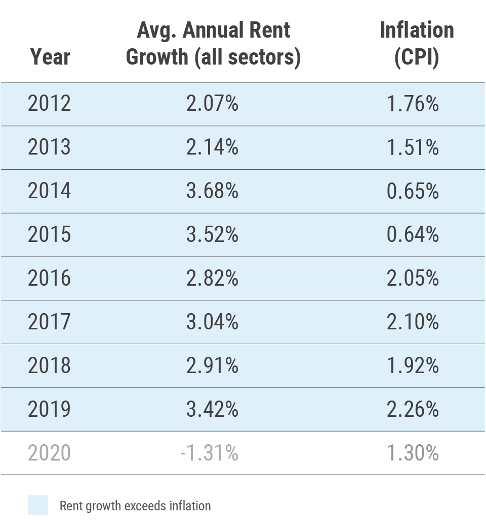

CRE property owners can raise rents to keep pace with inflation as operational costs increase. Whether by contractual lease language tying annual rent increases to the CPI or by property types with short-term leases like apartments, investors can benefit as inflation drives rents higher.

And with multifamily vacancy rates hovering near all-time lows*, owners have flexibility in their pricing power to raise rents higher than inflation, as these charts illustrate.

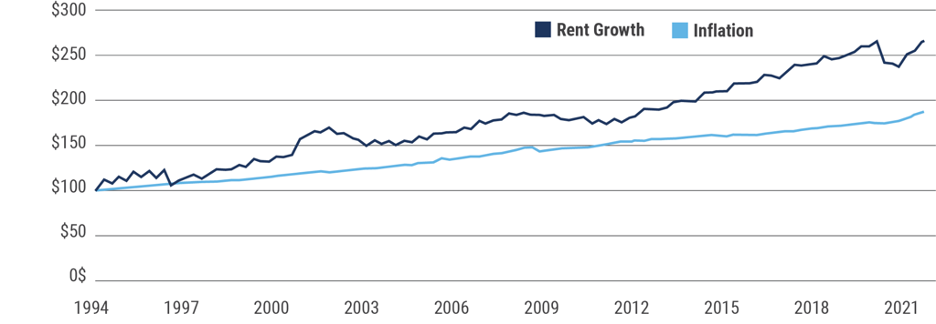

Commercial Real Estate Rents and Inflation are Highly Correlated

Source: Rent growth is represented by real estate net operating income: NCREIF; inflation: Moody’s Analytics; 01 Jan 1994 – 31 Dec 2021. Past performance does not guarantee future results.

Commercial Real Estate Rent Growth Often Exceeds Inflation (2012-2020)

In Summary

Commercial real estate is an asset class designed to provide consistent cash flows and the potential for price appreciation during different economic environments, including inflation. While not all income-producing properties are created equal, the variety of property types, markets, geographic locations, and tenants affords a broad ability to allocate commercial real estate as a meaningful diversifier to your clients’ investment strategies.