Evaluating the potential risks and returns of a commercial real estate (CRE) investment opportunity is one of the most important tasks you perform for your clients. And understanding the different layers of capital used to purchase and operate CRE assets starts by recognizing the categories that comprise the CRE asset’s capital stack.

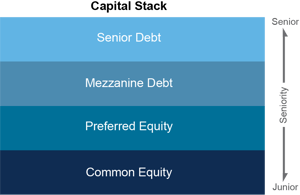

The capital stack refers to the layers of capital required for purchasing and operating a CRE asset and generally tells you the order of priority of payout with respect to other positions within the capital stack.

The capital stack refers to the layers of capital required for purchasing and operating a CRE asset and generally tells you the order of priority of payout with respect to other positions within the capital stack.

The most common four layers of the capital stack in real estate investments are common equity, preferred equity, mezzanine debt, and senior debt. Senior debt is top priority and will be paid out first, then the mezzanine debt, then the preferred equity and finally the common equity. If the real estate investment doesn’t perform as projected, there may not be enough money to repay all money invested along with returns. In that instance, the top priority layers (senior and mezzanine debt) would be repaid first, and the top layers will incur losses before anyone else (preferred and common equity). For the remainder of this discussion, we will focus on the debt portion of a capital stack, commonly referred as CRE credit.

CRE Debt Structures

Senior Secured Debt

Senior Debt holds the top priority position in the capital stack and has the lowest risk/return profile. This is because the underlying property secures the loan, and the lender would assume property ownership if the borrower defaulted on its mortgage. It typically receives the lowest rate of return of any other position in the stack.

Mezzanine Debt

Mezzanine debt, also referred to as subordinated debt, holds the second most senior position in the capital stack and has a more moderate risk/return profile. Mezzanine debt investors have limited foreclosure rights subject to agreements with senior debt holders and get paid after senior debt holders in the event of an ownership default. Subsequently, mezzanine debt generally pays a higher return than senior secured debt investments because they tend to be shorter term and have a higher risk profile.

CRE Credit Investment Structures

The various forms of debt structures within a CRE asset’s capital stack are also referred to as CRE credit. Two common CRE credit private investment structures are private equity funds and commercial mortgage real estate investment trusts (REITs).

- A CRE credit fund is offered by private equity firms, and the fund is the vehicle that makes loans to commercial borrowers with privately sourced capital. Investors receive their share of the income from payments on the underlying loans.

- A CRE credit REIT serves as the lender and generates portfolio income based on the spread between the interest income collected on mortgage assets and funding costs.

The typical goal of these types of CRE credit products is to primarily originate loans that are in a senior position within the capital structure. Therefore, if property values drop, the equity portion may lose value, but the borrower frequently continues to make loan payments to protect their equity portion. However, CRE credit investments are also subject to default risk, which means that the loan performance will be negatively impacted if the borrower stops making loan payments.

Floating or Fixed Rate?

Another factor to consider with evaluating CRE credit investments is whether mortgages are written with fixed or floating (adjustable) rate financing.

- Fixed-rate mortgages help protect borrowers against rising interest rates. Borrowers eliminate a significant source of cash flow uncertainty by locking in a fixed rate for the loan term. On the other hand, borrowers give up flexibility with fixed-rate financing and generally cannot refinance without substantial prepayment penalties.

- Conversely, floating-rate loans allow for the borrower’s rate to adjust when economic conditions change. These loans reset every 30 days, typically fluctuating with interest rate levels. This means that as interest rates rise, so will the rate on the floating-rate loan, generating higher returns than fixed-income loans. Amid today’s bond market environment, floating-rate loans are a unique and attractive characteristic of some CRE credit strategies.

We trust this discussion has simply outlined the CRE capital stack and the risks and returns associated with the different structures within it, allowing you to make well-informed decisions when considering a private commercial real estate allocation for your clients.