Get an Inside View of Inland Private Capital Corporation’s History and Current Investment Solutions

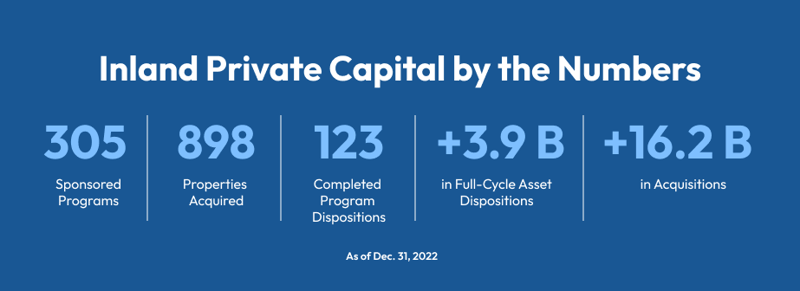

Inland Private Capital Corporation (IPC or the Company), an integral member company of The Inland Real Estate Group of Companies, Inc. (Inland), which has stood as a beacon of innovation in the commercial real estate industry for more than 55 years, has distinguished itself by spearheading tax-oriented investment strategies, fundamentally transforming the 1031 exchange landscape and beyond.

ConnectCRE, a commercial real estate industry publication reporting on transactions and trends, recently interviewed several key IPC executives to learn more about the Company’s growth through the years. View the full article including several video discussions here.

Pioneering Spirit in Tax-Advantaged Real Estate Investments

Offering a fresh perspective that facilitated shared ownership among investors utilizing 1031 exchange transactions, IPC cemented its position as an industry pioneer but also underscored its resilience through economic turbulence, such as the 2008-2009 great financial crisis which saw many contemporaries’ falter. The enactment of the Qualified Opportunity Zone (QOZ) program as part of the Tax Cuts and Jobs Act of 2017 opened another avenue for IPC to demonstrate its innovative edge and highlighted IPC’s ability to cater to a broad spectrum of investor goals.

IPC’s strategic journey has been marked by a deliberate expansion into various real estate sectors beyond the traditional realms of retail, office, multifamily, and industrial properties. Leveraging a research-based investment philosophy, this diversification strategy led to investments in sectors such as self-storage, student housing, build-to-rent, and healthcare.

Find out more about IPC at inlandprivatecapital.com.