The financial markets in 2025 have been characterized by heightened uncertainty and volatility, leading to increased challenges for investors seeking capital preservation and appreciation. The divergence between public and private market returns has been stark in recent years.

Market Turbulence and Investor Sentiment

Recent market events have amplified the need for mitigating volatility in public markets. In the days following the Trump Administration's tariff announcements, the S&P 500 suffered its worst day since 2020 and lost $2.33 trillion,1 while the CBOE VIX index, the primary measure of public market volatility, increased significantly by 30 points,2 highlighting mounting uncertainty. Although the markets have since recovered, this episode underscores the fragility and volatility of public markets.

Google Trends indicate a rise in searches related to uncertainty, volatility, and investment strategies, suggesting growing concern about building portfolios that can endure market turbulence and deliver steady returns.3 In a world full of escalating uncertainty, it is important to diversify portfolios into asset classes and investments with low correlations and historically strong return profiles, backed by stable demand drivers.

Return and Risk Profiles in Real Estate

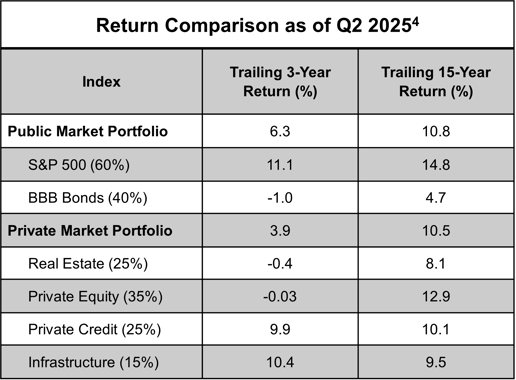

Historically, investment portfolios have focused on the traditional 60/40 allocation to stocks and bonds. Over the trailing three-year period, private markets returned an annual average of 3.9%, compared to 6.3% for a traditional 60/40 portfolio. However, over a 15-year horizon, private markets delivered 10.5%, closely aligning with the 10.8% return of the 60/40 portfolio.4 Despite similar long-term returns, private markets, such as real estate, offer lower correlations to public markets which can reduce volatility and enhance stability during downturns. Lower correlations may be indicative of demand drivers that differ from the public market. This diversification can help mitigate risk while providing the potential for strong returns.5

Correlation Matrix (2015-2024)5

Return and Risk Profiles in Real Estate

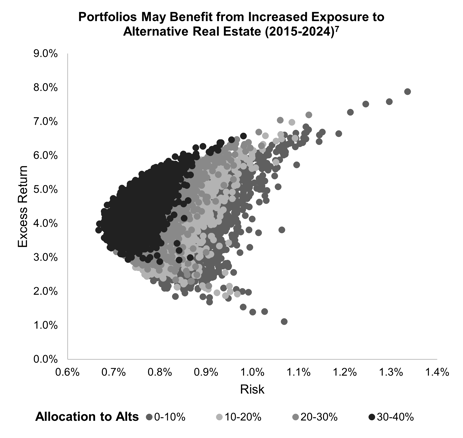

When constructing a balanced real estate portfolio, diversification across both property types and geographic locations is key. Traditionally, real estate allocations have been dominated by four property types: office, apartments, retail, and industrial assets. Today, however, there are an expanded range of options for investor consideration: self-storage, senior housing, medical outpatient buildings, data centers, cold storage, and student housing, which cumulatively are often referred to as “alternative real estate.” Each of these offers a unique blend of demand drivers, is less correlated to the overall real estate and equity markets and has the potential for attractive risk-adjusted returns. Investors seeking to construct a diversified and well-balanced portfolio should provide serious consideration to including alternative real estate to assist in potentially increasing returns while also reducing overall volatility.6

Risk vs Returns (2008-2024)6

Efficient Frontier7

The scatterplot to the right maps the risk-return trade-off of 10,000 hypothetical real estate portfolios, each with randomly generated allocations between traditional and alternative real estate sectors. The portfolios with larger allocations to alternative real estate shift the efficient frontier outward by delivering superior risk-adjusted returns compared to the portfolios with higher allocations to traditional real estate sectors. This performance improvement is driven by a critical combination of alternative real estate's strong demand drivers, non-cyclical nature, and lower correlation to the broader market.

*The real estate portfolios reflected in this scatterplot are hypothetical and intended solely to illustrate how allocations to alternative real estate can potentially shift the efficient frontier outward. The scatterplot is not intended to provide a recommendation of investment.

In a world full of uncertainty and volatility, finding ways to diversify a portfolio and increase alpha is essential for long-term investment success. The inclusion of alternative real estate in portfolios is a compelling strategy, as self-storage, senior housing, medical outpatient buildings, and student housing may provide unique advantages that are often less correlated with broader market movements. By incorporating these asset types, investors can construct a well-balanced portfolio with diversification, resilience, and the potential for attractive long-term returns.

Sources:

1 https://www.reuters.com/markets/sp-500-loses-24-trillion-market-value-biggest-one-day-loss-since-2020-2025-04-03/

2 https://shell-capital.com/asymmetric-investment-returns/why-was-the-vix-only-30-on-april-3-a-study-in-volatility-underreaction-and-asymmetric-risk-signals#:~:text=Everyone%20is%20wondering%20why%20the,But%20not%20this%20time.

3 https://trends.google.com/trends/

4 S&P 500 = Mornigstar, BBB Bonds = ICE BofA BBB US Corporate Index Fred, Real Estate = NCREIF Expanded NPI, Private Equity = Buyout (50%) + Growth Equity (25%) + Venture (25%) iCapital Q2 2025 Chartbook, Private Credit = Direct Lending iCapital Q2 2025 Chartbook, infrastructure from iCapital Q2 2025 Chartbook

5 Data covers years 2015 – 2024. Stocks: S&P 500 TR USD (1936) Morningstar, US 10-Year T.: US 10-Year Treasury Return Aswath Damodaran NYU Stern, Bonds: ICE BofA High Yield Index Total Return (50%) + ICE BofA US Corporate Index Total Return Index (50%)FRED, Private Equity: Leverage Buyout (50%) + Growth Equity (25%) + Venture Capital (25%) iCapital, Hedge Funds: iCapital, Infrastructure: iCapital, Direct Lending: iCapital, Core RE Funds: ODCE Index NCREIF, Traditional RE: Office (25%) + Industrial (25%) + Retail (25%) + Apartment (25%) NCREIF, Alternative RE: Self-Storage (25%) + Senior Housing (25%) + Medical Outpatient(25%) + Student Housing (25%) NCREIF; Data is 2015-2024

6 NFI-ODCE represents the NCREIF Fund Index - Open End Diversified Core Equity, which is a capitalization-weighted, gross of fee, time-weighted return index of investment returns of the largest private real estate funds pursuing lower risk investment strategies utilizing low leverage and generally represented by equity ownership positions in stable U.S. operating properties diversified across regions and property types. Full details on NFI-ODCE index can be found here: https://user.ncreif.org/data-products/funds/ Source: NCREIF NPI-Plus; Data calculated from properties held in NFI-ODCE Funds. Past performance does not guarantee future results. NCREIF – Traditional = 25% Office, 25% Industrial, 25% Retail, 25% Apartment | Alternatives = 25% Self-Storage, 25% Senior Housing, 25% Student Housing, 25% Medical Outpatient.

7 NCREIF Expanded NPI Returns 2015-2024 | 10,000 portfolios with randomly generated weights, where alts can make up 0-40% of the total allocation

Opinions expressed reflect the current opinions of Inland Real Estate Investment Corporation as of the date appearing in the materials only and are based on Inland Investment’s opinions of the current market environment, which is subject to change. Investors, financial professionals and prospective investors should not rely solely upon the information presented when making an investment or tax decision and should consult with a professional when making any decisions related to their personal investments or taxes. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broadbased economic, market or political conditions and should not be construed as research, or investment and tax advice.